A Framework for Early-Stage Business Model Design in Advanced Therapeutics Startups

Based on an Investigation of European Cell and Gene Therapy (CGT) Startups

Note: Originally published on October 11th, 2023.

This post is a practitioner-oriented breakdown of findings from my research for CDL-Oxford. While my research focused on early-stage CGT startups, some results may be transferable to other types of therapeutics and biotech startups.

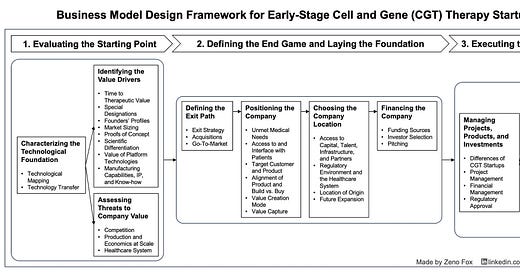

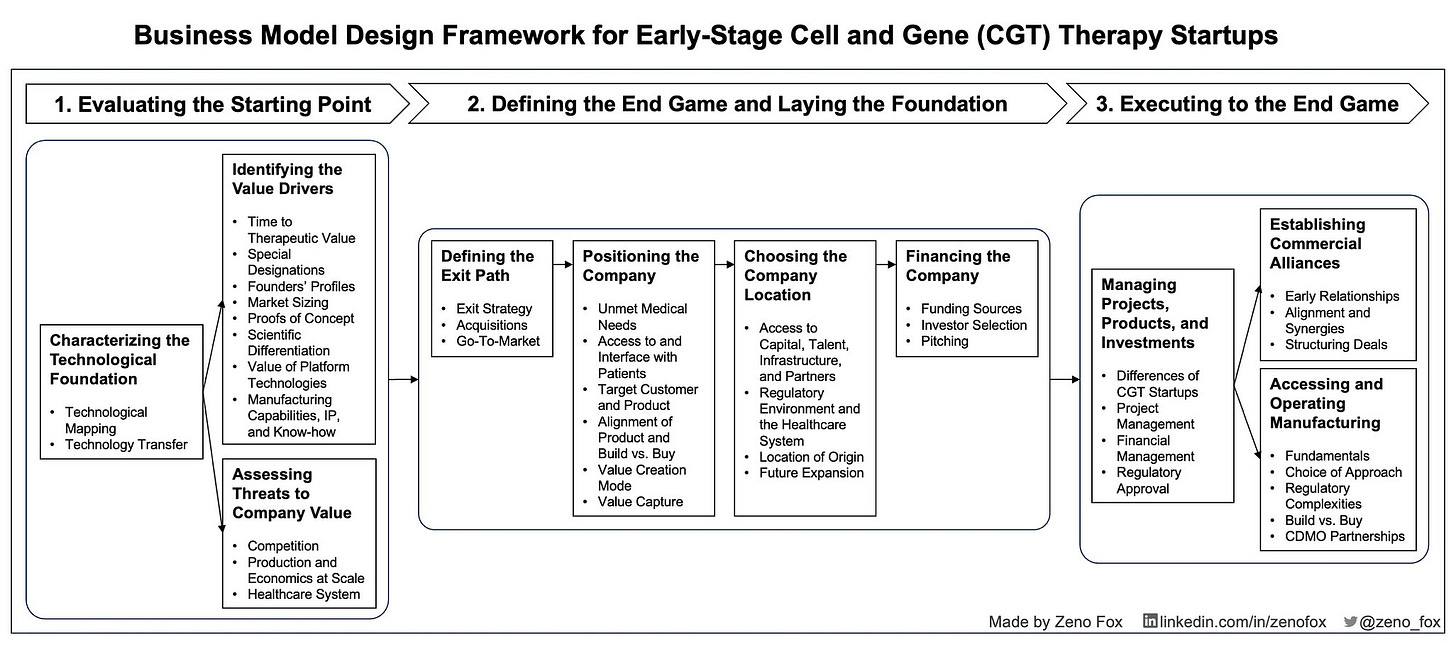

The research produced two main results:

An outline of important design steps and decisions

A mapping of dependencies between individual design decisions

The framework differs from existing research perspectives mainly in two ways:

It takes a holistic and integrative view on the business model level rather than focusing only on individual design decisions and components

It refutes the “move fast and break things” mantra of the tech startup world for most CGT startups and emphasizes long-term planning over short-cycled iteration

One of the founders I interviewed inspired me to write this post. When hearing about the insights, the founder urged me to share them publicly “because a lot of people will learn so much by thinking about this much early on” and “would not make the same mistakes.”

“We've been through multiple accelerators and startup programs as first-time entrepreneurs trying to learn how to build a CGT startup. No one ever told me this, and now it's so obvious. I was smiling when you were telling me this because it's the learning of the past six months, I would say. And now it's so obvious, but I'm still struggling to get my team to understand that because it's not something that would typically be instructed in any of these programs.“

~ A CGT founder’s response to my findings

Introduction & Context

Cell and gene therapies (CGT) have emerged as some of the most important advanced therapies and biologics. Their emergence has been driven mainly by small biotech startups, not big pharma. For example, over 90% of gene therapies are being developed by startups. CGT startups have received the most venture capital funding of all biotechnology platforms and are increasingly dominating drug development pipelines.

However, their business models are severely underresearched. Most of the little existing research was published before 2013. Thus, I took on the topic of CGT business model design and developed a framework for early-stage startups in my research for the Advanced Therapies stream of the Creative Destruction Lab Oxford (CDL-Oxford), a leading accelerator for massively scalable, seed-stage, science- and technology-based companies. I am deeply grateful to Kutlu Kazanci from the wonderful CDL-Oxford team, who enabled me to collaborate with them.

Methodology

The resulting framework was developed inductively based on the methodology suggested by Gioia et al. (2013), using data from semi-structured expert interviews with executives from 11 early-stage cell and gene therapy startups from Europe. To qualify, companies had to be:

clearly CGT-related

identifiable as startups based on their public appearance and/or venture capital backing (up to Series A)

founded less than five years ago

and headquartered in Europe

The population was mapped holistically based on publicly available data, and then a theoretical sample was drawn. A CGT startup landscape created based on this mapping is linked below:

100+ Early-Stage Cell and Gene Therapy Startups from Europe

Introduction Hi, and welcome to my first post! This is a list of early-stage cell and gene therapy-related startups based in or founded in Europe. I created this list as part of my research on the business models of European CGT startups. If you are part of one of the startups from the list or know someone there, please

Overview of the Framework

Fundamental Properties of CGT Startups

Unlike many software startups, CGT startups have a fixed scientific foundation; their Intellectual Property (IP) cannot be pivoted in most cases. Furthermore, CGT startups usually have very high technical risk and relatively low market risk since the success of their therapeutic products is mainly determined by efficacy and safety. The resource-intensive regulatory approval process also prevents iteration and pivoting because any product-related changes would require restarting trials, implying significant and often fatal costs for therapeutics companies. Consequently, CGT startups cannot adopt the “move fast and break things” mantra from the tech startup world. Instead, they must focus on long-term planning and management of technical, regulatory, and financial risk to prevent development failures, reduce capital requirements, prevent sunk costs, and ensure regulatory approval.

Fundamental Principles of CGT Business Model Design

Given the lack of flexibility and inability to pivot or iterate, only approaching product development based on long-term planning is insufficient for CGT startups. The startups must also design their intended business model early on and step by step to account for interdependencies between business model design decisions and product development requirements, as both types of decisions become increasingly difficult to reverse over time. Each business model design decision is highly interdependent and must be aligned with all its related decisions to issues and friction down the road. For instance, a company must align its commercial partnerships with its intended exit path, as some partnership terms may interfere with certain exit scenarios. A more specific example would be a CGT platform company’s acquisition that depends on the terms used to license parts of the platform to customers. If the company does not ensure that its licensing terms still make it attractive to potential acquirers, it may not be acquired later. Understanding and factoring in all such dependencies is crucial to designing a viable business model.

Main Thesis of the Framework

The main thesis driving the framework can be summarized as the following: CGT startups must define a clear “end game” early instead of continuously iterating towards an emerging vision over a long time, as many tech startups would. That end game can be understood as a concrete vision of the “game” the startup wants to play in the long term, assuming their technology and assumptions work out. Once a CGT startup has set its end game, it must work towards it by making subsequent design and execution decisions that align with it. This results in a more linear path than the iteration-heavy path of most startups from other fields.

This approach is necessary because:

In CGT startups, the scientific foundation is fixed, regulatory approval processes leave no room for change, and some strategic decisions become almost irreversible over time. Long-term planning is necessary to prevent costly or even fatal setbacks.

In business model design, the whole is greater than the sum of its parts. Collective alignment of design decisions is crucial to prevent friction and blockage.

Step-By-Step Explanation of Framework

1 Evaluating the Starting Point

1.1 Characterising the Technological Foundation

1.1.1 Mapping of Scientific Discoveries and Technological Capabilities.

Scientific and technological developments can fundamentally disrupt CGT business models. Regardless of the technology, efficacy, and safety are the most crucial properties of platforms and products. Understanding a startup's technological foundation is critical to business model design. It enables scoping and mapping of

potential applications and draws attention to technological properties that may have important business model implications. Broadly, the technological foundations of CGT startups are segmented into platforms and therapeutic assets.

1.1.2 Relationship with the Tech Transfer Office (TTO).

Most of the interviewed companies were spinoffs and thus had to go through spinout processes. For this, navigating the relationship with the TTO is critical. An interviewee with deep expertise in tech transfer noted, “There's just a whole world of different things out there you just don't know about as a first-time founder.” Consequently, first-time founders should seek experts “who understand the ecosystem from many different perspectives” and can fill the team's knowledge gaps by providing trustworthy and balanced advice. Partners at the affiliated TTO should understand startup operations, investing, and legal matters.

1.2 Identifying the Value Drivers

1.2.1 Time to Therapeutic Value

The time to the therapeutic value of individual therapeutic products plays a crucial role in saving patients' lives through timely treatment and ensuring high applicability for an indication. For most CGTs, the time to therapeutic value is still considerable, taking up to six months in some cases, but companies are working to shorten it to just days or weeks. The underlying technologies, manufacturing, and logistics are the main levers to achieve this.

1.2.2 Eligibility for Special Designations

The Orphan Designation awarded by both the FDA and EMA, as well as the Rare Pediatric Disease Designation (RPDD) awarded by the FDA, significantly impact the business cases of advanced therapy medicinal products (ATMP) startups and can attract investors. Thus, ATMP startups should investigate whether their therapeutic products are eligible for those designations and factor them into their business cases.

The orphan designation provides 7 to 10 years of market exclusivity for the targeted indication upon regulatory approval, meaning that no other therapeutic products targeting the same indication can be sold within that time frame unless regulators decide that they are fundamentally different or treat a different aspect of the disease. The orphan designation also implicitly guarantees high pricing, making orphan drugs some of the most profitable on the market. The RPDD awards the company with a fast-track voucher upon regulatory approval of its therapeutic product. This voucher can be used to fast-track the approval process for an additional therapeutic product or sold to other therapeutics companies for around €160M to €180M.

Both designations lead to the regulators providing more advanced guidance on navigating the approval process. Both designations imply a reduction in the number and size of clinical trials and lead to changes in the process.

1.2.3 Founders' Experience, Network, and Reputation

The broader founding team, including advisors and board members, provides value through their experience, expertise, reputation, and network.

1.2.4 Market Size Based on Indications, Patient Population, Adoption, and Pricing

The market size of a therapeutic product drives its and is defined by the applicable indications, their patient population, the adoption rate, and pricing. The patient population, its subpopulations, and competing therapeutic products, including products on the market and in the regulatory pipeline, are usually easily evaluated. Based on these factors, the adoption rate of the therapeutic product, assuming it is successfully approved, can be estimated.

Pricing is either value-based, based on the clinical value and cost reductions, or competition-based when similar products are available. Value-based pricing becomes less common when competing products reach the market. Cost-based pricing is not considered suitable. Pricing is not considered a significant purchase argument for therapeutic products, as other characteristics like reliability, safety, and efficacy supersede it.

1.2.5 Scientific, Commercial, and Patient-related Proofs of Concept

Proofs of concept provide data points that drive the company value. These proof points can be divided into scientific, commercial, and patient-related validation. Scientific validation of platforms takes the form of proof points for individual platform components or of successfully developed therapeutic products that validate the platform as a whole. Scientific validation for individual therapeutic products is centered around pre-clinical and clinical data. Commercial validation relates to the interest of commercial partners, as indicated by commercial partnerships like licensing deals or at least declared interest. Patient-related validation relates to patient interest in the platform or therapeutic product and patients actively searching for alternatives to existing products.

1.2.6 Degree of Scientific Differentiation

For established approaches, there is an awareness of the risks, limitations, and competing approaches. In contrast, novel and strongly differentiated approaches open up new possibilities instead of incremental improvements and have fewer perceived limitations because their flaws and risks are yet to be understood. This makes novel approaches more valuable.

1.2.7 Value of Platform Technologies as the Sum of Their Potential Applications

Fundamentally, the value of a platform is the sum of the value of its applications. These can be validated applications with proven value-add and potential applications that are not yet validated. In the long term, the platform's value converges to the value of products that can realistically be made with it. Additionally, the optionality of platforms is valuable in and of itself because it mitigates risk. Capturing the full value of the platform is achieved by specifically bundling its different capabilities and components into products that are tailored and licensed to several different customers and their specific use cases.

1.2.8 Manufacturing Capabilities, IP, and Know-how

In the context of ATMPs, and especially cell therapies, the core Intellectual Property (IP) is concentrated around the manufacturing process rather than the therapeutic asset itself. In some cases, the production process varies even from patient to patient. In addition to the IP, there is know-how around optimizing the process further. Consequently, owning and controlling the IP around the manufacturing process is critical. Thus, it is also implied that manufacturing data is valuable, should be collected, and should not be shared with third parties. While some companies already integrate data into their core strategy, the entire industry still grapples with how that data can create tangible value.

Another factor that plays an important role in manufacturing is the cost of production. According to I6, in the long run, “All you have is your ability to manufacture the dose at lower cost with higher success rate than your competitors. And this is process.” To drive down this cost of production and ensure competitiveness within an indication, many startups are investing in automated manufacturing technologies.

1.3 Assessing Threats to Company Value

1.3.1 Viability of Competition

Novel generations of technology platforms and their associated therapeutic products tend to replace existing platforms and therapeutic products due to superior characteristics, like safety, efficacy, and ex-vivo versus in-vivo approaches. Due to the fast-moving nature of CGT, this replacement may occur very quickly after the first generation of products is approved. Overall, this might lead to the dominance of very few superior platforms. This dynamic is reinforced by the fact that existing technology platforms can only address a narrow range of biological targets, leading most CGT companies to compete for the same indications, creating higher competition than in other therapeutic classes. Therapeutic products that are successfully approved might face considerable competition for their indication, leading to price-based competition and, thus, declining margins. Further drivers of this competition around the same indications are their market sizes and the availability of potential exit partners.

The likely resulting market dominance of very few superior platforms and therapeutic products is enforced by regulators, as only therapeutic products with superior efficacy or safety than already-approved products can be approved. Technology platforms with broad applications may be at particular risk for these competitive dynamics. However, even products that do not obtain regulatory approval can still threaten similar or competing products and the underlying technology platforms. This is because failures within a therapeutic approach impact the perception of different stakeholders of both the underlying platforms and their derived therapeutics within that approach.

1.3.2 Viability of Production and Economics at Scale

For CGTs to be viable, their market size must be sufficiently large, and the cost of goods sold (COGS) must be viable at scale. What is considered a viable COGS depends on the size of the patient population. For example, COGS above €400k for a CAR-T therapy would not be viable for the mass market but may be viable for orphan drugs. Cell therapy, in general, may be unviable for auto-immune diseases due to its high price point. Previously, COGS was an overlooked factor, which led to the commercial failure of approved cell therapies. However, stakeholders are now paying close attention. Thus, I11 states: “Today, I would argue that if they are not a fool, investors investing in cell therapy companies will look at manufacturability and scalability before even looking at the asset.” COGS is less critical for gene therapies since they are comparatively and increasingly cheap to manufacture.

1.3.3 Viability for the Healthcare System

The price tag of CGTs is considerably higher than other therapies. These high price points raise questions about their cost-benefit ratio during health-technology assessments in the reimbursement process, which can become problematic. Thus, developing a strong pharmacoeconomic case for each CGT becomes decisive for its commercial success. The high price points put a severe financial burden on the healthcare system when therapies get approved, which generally disincentivizes the healthcare system to reimburse them. Public health care systems have limited budgets, making exceeding that budget their biggest problem. Thus, their budget for CGTs is strictly limited, and private healthcare is expected to step in.

Two additional points of concern for the healthcare system are cases of unsuccessful treatment and whether or not CGTs will be one-shot or require multiple doses over an extended time horizon, as both would significantly impact the total cost of treatment per patient. Therapeutics companies are addressing these concerns with mechanisms like refunds, but this is still seen critically. Different financing mechanisms and transaction models allowing paying for CGTs over an extended period rather than upfront might make CGTs more viable and enable cost savings for healthcare systems.

2 Defining the End Game and Laying the Foundation

2.1 Defining the Exit Path

2.1.1 Exit Strategy Depends on Risk, Preferences, Scientific Data, and Opportunity

Generally, the potential exit paths of CGT startups can be divided into two categories: product exits, where an individual asset like a platform or therapeutic product is exited, and company exits. Both are achieved through acquisitions or going public. Whether or not acquisitions are a viable exit path depends on the availability of potential acquirers. Going public usually requires a company to fulfill certain criteria, like having a multi-asset product pipeline, commercial traction, and a long-term growth story. Going public can be driven by a need for capital that exceeds the capital availability in private markets, shareholders' need for liquidity, and a lack of viable acquisition paths.

Different founding teams and investors have varying preferences toward specific exit types. The exit timing is a function of risk management and expected validation thresholds. Founders and investors manage their financial risk and the risk-return trade-off by choosing to exit earlier or later. Founders are also factoring in their personal preferences for the company stage and type into this. Furthermore, opportunism can change. Scientific validation in the form of pre-clinical and or clinical data plays a vital role in when a company or product can be exited, as certain validation thresholds are expected to be reached and differ in value depending on the exit type, the therapeutic platform, or product, and the state of financial markets. The less mature a therapeutic space is, the lower the required validation thresholds are.

2.1.2 Acquisitions are Determined by Value-add to the Acquirer

The value-add for an acquirer can be the technology platform, the team, or the therapeutic product. In addition, case-specific rationales for acquisitions may center around obtaining the know-how and talent inherent in a CGT startup. Platforms and therapeutic products have different value propositions for acquirers.

A technology platform's value is that it can integrate into the R&D organization of the acquirer to expand its tools and product pipeline. The more important the platform, the earlier are acquirers willing to make acquisitions to secure access for the case of successful validation and to block off competitors' access to the platform, even when little validation has been done.

The value of a clinically proven therapeutic product is that it provides a short path to a new revenue stream and utilizes the marketing capabilities of the acquirer. Furthermore, a clinically proven therapeutic product replaces outdated therapeutic products in the acquirer's portfolio, allowing it to defend its established market position. For the players who act as acquirers, it is noticeable that many big pharma companies have yet to make large acquisitions around CGT platforms.

2.1.3 Going to Market Depends on Capital Availability, Viability, and Transformation

Taking a therapeutic product to market and selling it to healthcare systems requires at least hundreds of millions of euros of capital. As a result, few startups can take their therapeutic products to market themselves. The models and playbooks for successfully taking therapeutic products to market in the CGT space are still emerging. In some cases, taking the therapeutic product to market is necessary due to a lack of commercial partners and acquirers. Going to market requires CGT startups to transition from an R&D-focused organization to a commercialization-focused organization, manufacturing, and distribution, and thus poses a significant transformational challenge. Furthermore, it often involves taking the company public to access the required capital amounts and provide liquidity to existing private investors.

2.2 Positioning the Company

2.2.1 Targeting of Unmet Medical Needs

Therapeutic products must address an unmet medical need.

2.2.2 Access to and Interface with Patients

Access to patients is crucial to conducting clinical trials and commercializing approved CGTs. Access can be obtained through partnerships with hospitals, specialized centers of care, and patient organizations. As part of such partnerships, hospitals and specialized care centers can provide the entire interface to the patient, including caring for them, ensuring a robust clinical pathway, and other clinical capabilities.

2.2.3 Target Customer and Product Depend on Company Stage and Intended Exit Path

The target customer of a CGT company is a function of its stage and intended exit path. In the initial stages, the customers are investors buying equity in the company based on the team, IP, advisors, and other factors, expecting meaningful financial returns. Once the platform or product reaches a particular maturity, the customers become pharmaceutical and biotech companies looking to obtain a license to access the company's technology. When the company goes to market, its customers become the healthcare systems it serves.

2.2.4 Alignment of Product and Build-vs-Buy Decisions with the Intended Exit Path

Lifecycle management and considering the intended exit path play key roles in developing products that can be successfully exited. For this reason, startups establish early relationships with potential commercial partners and engage in discussions to determine and validate an attractive product positioning. Developing the right position also involves aligning the company's build-versus-buy decisions and internalizing components that are value drivers for the intended exit path.

2.2.5 Value Creation through Clinical, Process, or Engineering Focus

Generally, CGT startups tend to have very lean teams focusing on specific competencies. Their mode of value creation differs and can be categorized into three archetypes. Companies with a clinical focus concentrate on clinical data and are led by medical professionals, therapeutics experts, and user researchers. Companies with a process development focus have processes as their cornerstone and are run by process development experts. Companies with an engineering focus on building tools and are run by engineers. The choice of the mode of value creation seems to be based on the competencies of the founding team, their competitive advantage, and initial hiring decisions.

2.2.6 Value Capture through Blue Ocean Focus and Hybrid Business Models

CGT companies can capture more value by focusing their product development on blue oceans, areas characterized by the lack of competition, rather than red oceans, areas characterized by strong competition. For therapeutic products, this area is defined by indication, and for technology platforms, the platform capabilities. Since the value in biotech is created by therapeutic products reaching the market, platform companies can capture additional value by internalizing assets and developing their own therapeutic products in-house. These products can be licensed or exited at different development stages. Although such a hybrid model requires more resources, more companies are pursuing it. Hybrid models can be used to hedge against the risk of being unable to secure commercial partnerships early on, as well as becoming dependent on partners' decisions about the progression of compounds. In addition, hybrid models allow for continuing the development of out-licensed compounds given up by partners. Furthermore, hybrid models can target and attract a broader range of investors due to the variety in investment preferences and an increased value capture in-house. Moreover, hybrid models can validate the underlying platform, as successfully developed products are proofs of concept.

2.3 Choosing the Company Location

2.3.1 Access to Capital, Talent, Infrastructure, and Partners

A company's location choice should consider access to and cost of key resources. First, access to talent pools, the ability to compensate top talent across functions and hierarchy levels, an ecosystem of CGT companies that provides a safety net to employees if a company fails, and the quality of life at the location should be considered. Second, access to key partners like research institutions, care providers, contract research organizations (CROs), contract development and manufacturing organizations (CDMOs), and commercial partners is crucial. Third, access to and cost of infrastructure matter. Fourth, access to private and public markets is important for fundraising.

Overall, different locations present different tradeoffs:

The United Kingdom has strong universities and a large talent pool. However, it offers lower salaries, which can be a challenge in attracting and retaining top international talent.

Germany has high salaries, high regulatory hurdles, especially for gene therapy, fewer international talent, and fewer pharma companies compared to other locations.

France has a very centralized environment with strong universities but high barriers for internationals.

Switzerland has a business-friendly and international environment with an established pharma and biotech ecosystem. It offers high salaries and quality of life while accessing talent pools from neighboring countries, allowing companies to compete for international talent.

The United States of America (U.S.) has extensive talent pools and strong financial markets. However, they are at least partly offset in the early stages due to the extremely high price points for lab space, employee salaries, and other key resources, even compared to the most expensive European countries.

2.3.2 Implications of the Regulatory Environment and the Healthcare System

Jurisdictions differ in the strictness of regulatory frameworks. As one interviewee explained, “America is all under the FDA. Whereas, in Europe, you've got the EMA. You've got the French EMA. You've got the Irish EMA. They're all different.” Also, the healthcare systems are structured differently, with the United States having a greater interest in expensive CGTs and having more centralized care provisions than Europe.

2.3.3 Reasons to Start in the Location of Origin

Some CGT companies naturally originate in locations where key resources and valuable support organizations, like the BioInnovation Institute, are already present. Moreover, the founding teams have local knowledge and networks and would have to start from scratch in a different location. Lastly, personal preferences and commitments, like professorships, also play a role.

2.3.4 Option of Future Expansion

Expanding to other locations to tap into their resources and markets is possible, with some CGT startups even planning this from their inception. One interviewed startup team planned from the beginning to found in Europe but move their headquarters to the United States after completing the pre-clinical stage to conduct research in Europe at a lower cost while accessing U.S. capital markets.

2.4 Financing the Company

2.4.1 Selection of Funding Sources

Typical funding sources for CGT startups are grants, convertible debt, and equity investments by private investors, foundations, and governments. In the later stages, revenue generation and different forms of debt can also be viable. Public funding is usually only suitable for startups before phase II clinical trials. Revenues are generated through development partnerships, out-licensing, and selling fast-track vouchers from approved RPDD therapies.

2.4.2 Choice of Investors Based on Alignment, Investment Style, and Signaling

Biotech investors are generally highly specialized and tend to have different foci for company positioning, business models, exit types, risk-return ratios, expected returns, time horizons, and other characteristics. During fundraising, founders should choose investors with an aligned focus to prevent investors from later interfering with the company's direction. Investors lacking an understanding of the company might sometimes force companies to pursue the wrong path. CGT startups might be able to hedge against investor misalignment by choosing a mix of investors with varying preferences to cover different strategic paths the startup might take. Lastly, companies should factor in the reputation and signaling of potential investors, as their involvement can attract more investors.

2.4.3 Pitch based on Investor Preferences, Milestones, Timeline, and Cost- Effectiveness

Given the variations in investor preferences mentioned above, companies should tailor their positioning and pitch to each potential investor during fundraising. Generally, CGT startup pitches should emphasize science and technology. Due to the very long timelines, CGT startups must demonstrate that they are managing their timelines and cost structures effectively. Business considerations are less vital, although CGT startups should be able to provide a high-level outlook on the intended go-to-market strategy. An interviewee explained how to structure an investor pitch:

“It's first explaining the core science you have. What is this? Is it a new molecule, a new target, and a new type of stem cell? What's the strength? And then, you show what data you generated [...] that supports this is good. And then you often show the development plans, and then you show the IP situation. You show competitors and also competitors in development very critically. And then you show some market potential and then team, that's what I have. Usually in that order, sometimes the plan moves to the end.“

The pitch structure should be tailored to emphasize the unique differentiators of the startup. Overall, the pitches are longer than in other industries, averaging one hour, including questions and answers.

3 Executing towards the End Game

3.1 Managing Projects, Products, and Investments

3.1.1 Differences between CGT Startups and other Businesses

CGT startups are fundamentally different from tech startups. Tech startups tend to have high market risk and relatively low technical risk. In contrast, biotech companies tend to have a low market but very high technical risk. The success of tech products is determined by user behavior and the overall market. The success of therapeutic products is driven by efficacy and safety, and there is little competition. From a technological perspective, tech products can be developed, iterated, and pivoted rapidly based on customer feedback. Consequently, the mantra of tech startup methodology is “failing fast and trying again.” For therapeutics startups, this approach does not work. The development timelines are significantly longer; therefore, iterating or pivoting would set companies back multiple years. CGT startups usually have a fixed scientific foundation and a costly regulatory approval process that restarts entirely after a pivot. Thus, a development failure often leads to the failure of the entire company.

3.1.2 Project Management to Address Technical and Market Risk

Due to the aforementioned properties of CGT startups, their methodology needs to be centered around technical and scientific risk mitigation through project management, timelines, development speed, and cost control. Companies should conduct “killer experiments” to invalidate the scientific and technological approach as early as possible to prevent sunk costs. When the invalidation attempt fails, startups can move on, determine the right commercial direction, and define a well-considered development plan and stage gates. Planning can prevent development failures that could destroy the entire company, making planning a key activity for CGT startups. When setting a direction, startups should ensure that their product targets an attractive market and will be competitive. This includes alignment with potential commercial partners and acquirers early on, throughout development, and during clinical trials to determine the right positioning.

3.1.3 Financial Management to Address Investment Risk

Due to the capital intensity of CGT startups, strict financial management, cost control, investment, and management are vital. Risk management and reductions in capital requirements can be achieved by avoiding capital expenditures, preventing sunk costs, and limiting the costs of failures. Another method for managing investment risks is a multi-asset approach that builds a portfolio of therapeutic products to limit the consequences of individual failures. However, developing multiple assets in parallel has significant capital requirements.

3.1.4 Obtainment of Regulatory Approval

The regulatory approval process for therapeutic products is a significant cost driver for CGT startups. The cost ranges mentioned in interviews were $5-10M for pre-clinical research, $15-20M for phase I clinical trials, around $100M for phase II trials, and $100-400M for phase III trials, depending on their size. Regulators of different jurisdictions vary in strictness. They can put trials on hold due to safety concerns, which can lead to the failure of the entire associated company. To obtain regulatory approval, companies must prove that their therapy is superior in efficacy or safety to approved competitors. CGT startups can optimize their trial designs by seeking input from commercial partners and analyzing trials conducted by big pharma.

3.2 Establishing Commercial Alliances

3.2.1 Early Relationships with Potential Pharma Partners

Relationships with potential partners should be built early to ensure that products will be desirable for partners and acquirers. How early partnerships can be established depends on the respective therapeutic area. Establishing partnerships can drastically reduce risk and capital requirements by avoiding investments in infrastructure and other resources. At the same time, partnerships can generate hundreds of millions of euros in revenue.

3.2.2 Alignment and Synergies with Partner Company

Platform companies and product companies often seek to establish partnerships with each other. This is because platform companies lack the expertise around biological targets to apply their platform, while product companies have deep target expertise but lack the required platform. Products developed through such partnerships might have a higher probability of success than products developed independently. In such partnerships, product companies seek exclusive licenses to apply the platform to specific sets of biological targets around their expertise. Some platform companies partner with other platform companies to advance their toolkit. An example of this is Vertex and CRISPR Therapeutics.

3.2.3 Structure of Deals and Licenses for Revenue Generation

Any licensing deal is exclusive to ensure that partner companies can successfully commercialize the developed therapeutic products. Licenses for individual therapeutic assets are single-target deals. Licenses for platforms bundle 3-5 therapeutic targets relating to the customer's expertise. The access to these targets is staggered. At first, only one target can be accessed. After validation, additional targets are unlocked. Licensing fees include upfront and milestone payments, royalties, and stock. According to one startup, upfront payments could range between $20M and $70M, while milestone payments range between tens and hundreds of millions. To mitigate the risk of licensors being dependent on the licensee's asset progression decisions, reversion rights can be implemented. Both licensors and licensees must consider how licensing terms might impact potential acquirers and partners. Thus, they should align with a company's intended exit path.

3.3 Accessing and Operating Manufacturing

3.3.1 Fundamental Considerations for CGT Manufacturing

CGT manufacturing benefits significantly from economies of scale. The equipment required to manufacture CGTs is usually unspecific and can be applied to various biologics. However, the manufacturing processes are often highly specialized. Advances in equipment and processes drive down manufacturing costs, making it more feasible for CGT startups to manufacture in-house.

3.3.2 Choice of Manufacturing Approach

While decentralized manufacturing is recommended for clinical development, a centralized manufacturing approach is often better for scaleup upon commercialization. In many cases, decentralized manufacturing can be more cost-effective and logistically beneficial. Due to logistical and regulatory complexities, like the turnaround time and inter-country transportation, some companies consider adopting jurisdictional manufacturing. They might establish manufacturing facilities in each European country rather than a single facility for Europe. The optimal degree of centralization also depends on the product type. Big pharma is perceived to struggle with decentralized manufacturing, which is the opposite of their current approach. To enable highly decentralized manufacturing, the infrastructure must be automated to the point where no trained staff is required. For operating manufacturing, two approaches exist: recipe control and adaptive control. Whereas recipe control uses sequential and separate processes, adaptive control parallelizes processes and automates process improvement. Whether regulators will permit adaptive control is unclear.

3.3.3 Regulatory Complexities of Manufacturing and Implications

For clinical trials, facilities with good manufacturing practices (GMP) licenses are required to ensure a minimum degree of safety and efficacy. Building and operating such facilities is a costly and lengthy process that must be factored into startups' development timelines. The construction of GMP facilities takes around three years, and obtaining the certification takes 18 to 24 months. The investments required to build and operate these facilities are too high for many startups. The main cost driver is the facilities themself, with a large component being the fixed costs for achieving GMP grade, regardless of facility size. To obtain a license, controls, flows, documentation, and working systems, the ERP, and everything manufacturing-related are audited by regulatory authorities. Currently, regulators require one license per facility, even if the facility is identical to an already-approved facility, because the regulatory framework was not created with decentralized manufacturing in mind. This poses a hurdle to decentralized manufacturing that may be resolved in the future. In addition to GMP licenses, aspects like data ownership, GDPR laws, and patient ethics must be considered for manufacturing. Operating GMP manufacturing is also costly due to the required materials, equipment, and operations staff. Establishing and operating GMP facilities is usually not viable for startups targeting small patient populations, like in the case of orphan diseases. Some startups, like Poltreg, build up their own GMP facilities and then monetize idle capacity by acting as a CMO.

3.3.4 Build-vs-Buy Decisions for Manufacturing Capabilities

Shared lab space can be accessed at nominal costs through incubation centers, universities, and commercial providers, allowing for a reduction of capital intensity. Like lab space, manufacturing capacity can be accessed through external providers, reducing capital requirements and risk. CGT startups may be able to reduce the upfront capital requirements for manufacturing services even more by offering royalty payments upon market entry instead of upfront fees to the CDMOs and CMOs they work with. Some CGT startups decide to focus only on R&D and thus decide to outsource manufacturing entirely. Startups generally risk becoming dependent on CDMOs, CMOs, equipment, and reagent providers. However, the CDMO sector for CGT has developed and continues to do so, reducing that risk. While clinical-stage startups might struggle to finance in-house manufacturing and must rely on third parties, startups that require commercial-scale manufacturing capacity should have access to credit lines. Nevertheless, the required timelines for establishing GMP-grade manufacturing facilities can lead startups to outsource.

Keeping manufacturing in-house can provide better quality assurance and patient or donor experience for therapies requiring patient or donor materials. Specialized processes and products with complex supply chains tend to be difficult to outsource and should be kept in-house. Small-scale production that can be performed at a large lab scale also favors in-house manufacturing. This is due to its lower costs and because contractors may not prioritize such products to the same degree as large-scale products. Potential problems of lab-scale production are the dependencies of university-related GMP units and the fact that small stand-alone labs are usually not viable. A solution may be container-based labs. Outsourcing can be favorable for standardized products with a large patient population requiring large-scale production without donor or patient materials.

3.3.5 Partnership with a CDMO

Working with CDMOs becomes relevant when a company needs access to GMP-grade manufacturing for clinical trials. However, the value-add of a CDMO can extend beyond manufacturing and include R&D. CDMOs can significantly accelerate the R&D process through their expertise. Furthermore, some CDMOs simplify the manufacturing process by abstracting away technical infrastructure and process considerations. The degree of abstraction varies. At a high level, CDMOs can be mapped on two axes. The first axis represents the breadth of services and ranges from access to technical infrastructure to comprehensive end-to-end services. The second axis represents the degree of specialization in a therapeutic area and ranges from generalists to specialists. When picking a CDMO, startups should evaluate how much expertise a CDMO has within their specific product area since the expertise and processes required can differ vastly. Compensation for CDMO services is usually based on a fee-for-service model. The pricing in such models is negotiable and usually based on the project, objectives, and work packages. Important aspects of the partnership are the scientific, technical, commercial, and legal terms.

Conclusion

Overall, the most important takeaway is that, in CGT business model design, the whole is greater than the sum of its parts. In other words, the interdependencies and alignment between different design decisions are at least as critical as individual decisions. A company's decisions must be fully aligned to foster synergies and prevent friction. This must be considered early on, as CGT startups usually cannot apply the move-fast-and-break-things approach for company building and product development. Instead, long-term strategy and planning should guide CGT startups, as many decisions will become increasingly irreversible over time.

A Few Words on Limitations

The qualitative research approach provided a deep and nuanced level of insight. However, it could only generate hypotheses without validating them. With the inductive approach, the generalizability of the research is limited. Furthermore, the framework does not differentiate between different types of CGTs. This may lead to over-generalization and missing out on more specific considerations. Some interviewees mentioned that aggregation and generalization of therapeutic approaches can be problematic.

If you enjoyed this post and know someone who might enjoy it as well, please share it with them. Thanks.